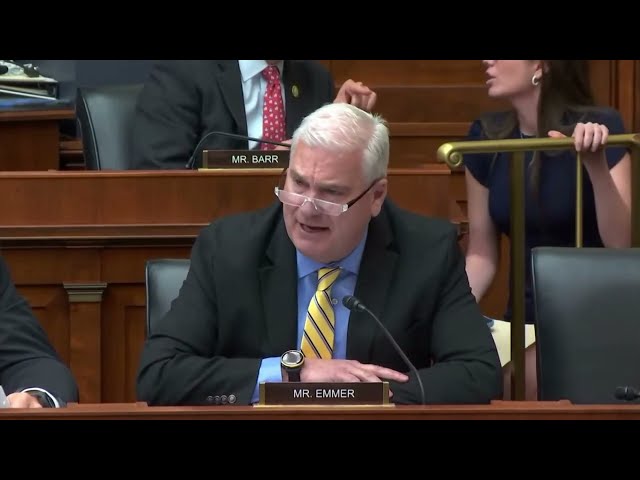

Washington, D.C. – Yesterday, Majority Whip Tom Emmer (MN-06) questioned Securities and Exchange Commission (SEC) Chair Gary Gensler regarding the SEC’s regulation-by-enforcement agenda, which only hurts everyday Americans instead of protecting them.

|

| WATCH: Majority Whip Tom Emmer questions SEC Chair Gensler |

Emmer labeled Gensler an “incompetent cop on the beat” for his role in confusing the marketplace and pushing American firms straight into the hands of the Chinese Communist Party.

A transcript of Emmer’s questioning can be found below.

Transcript:

Emmer: Thank you. Chair Gensler, I have a lot of questions and a limited amount of time, so if you could keep your answers to either a “yes” or “no,” that will allow us to get through as many as possible, sir. From your perspective is more difficult now for the digital asset industry to access financial products and services in the United States than it was, say two years ago?

Gensler: Sir, I have not been running one of those businesses, if they came into compliance -

Emmer: Reclaiming my time. The answer, sir, is “yes.” Do you think you and the SEC had a role to play in that?

Gensler: I think we have a role to protect the American investor and the capital markets and –

Emmer: Reclaiming my time, sir. You have played an obvious role in that. During your tenure at the SEC, how many rules has the SEC finalized that actually accommodate the existing regulatory framework specifically to the digital asset industry so the crypto market can come into compliance?

Gensler: It's their rule books that are on the books for a year. So, we have not finalized any new rule specifically with regard to crypto. We've proposed some things and best execution. We've also -

Emmer: Sir, reclaiming my time. The answer is zero. And how many enforcement actions has the SEC levied against digital asset companies during your tenure, sir?

Gensler: I think it's probably 40 or 50.

Emmer: The answer, sir, is about 55. My understanding is that the biggest crypto failure in history is probably FTX at $9 billion. Were you the Chairman of the SEC when FTX collapsed?

Gensler: Yes.

Emmer: And how many times did you meet with FTX prior to their collapse?

Gensler: I think my public record shows two.

Emmer: You met with FTX at least twice. And arguably the second biggest crypto failure in history was Terra Luna. Who was the Chairman of the SEC when Terra Luna collapsed, sir?

Gensler: We had brought -

Emmer: You were, sir. Reclaiming my time. You were. There are five members on the Commission, do you believe your speeches and interviews are to serve as the official position of the SEC?

Gensler: There, I can only speak for myself when I'm speaking -

Emmer: Again, sir, in a statement on the SEC website you are quoted saying, “The Kraken staking-as-a-service enforcement action should make clear to the marketplace that staking-as-a-service providers must register.” But again, you haven't provided any rules for how that can be done. I must remind you, your public statements are not regulations. It's not responsible to expect the American people to assume your statements are a substitute for rules.

Do you agree with this statement regarding the digital asset industry, the SEC needs additional congressional authorities to prevent transactions, products, and platforms from falling between the regulatory cracks?

Gensler: I think that it's a largely non-compliant field -

Emmer: Sir, again, I asked you to comply with my questions. And I'm asking you if you agree with that quote, and I am going to tell you, I'm quoting you from an August 3, 2021, article, and I believe you told Congressman Hill earlier that you need congressional authority to regulate stablecoins and stablecoins happen to be a significant percentage of the crypto market. So, the question is, when were you telling the truth? To Mr. Hill or to me? You've got to start answering these questions in a more transparent manner, sir.

Does it concern you, by the way, that your approach to the digital asset industry is actually driving this industry out of the United States?

Gensler: We are trying to drive it to compliance and if they're not complying with the laws, then they shouldn't be offering their products -

Emmer: Reclaiming my claiming my time. Madam Chair, I would like to enter into the record this Wall Street Journal article from April 14, 2023, detailing China's ploy to open its banking system to crypto firms in an effort to seize an opportunity created by our hostile regulatory environment, which, Mr. Chair you're a big part of.

Chairwoman Wagner: Without objection.

Emmer: Look, Chair Gensler, FTX was domiciled abroad and so is Binance. Yet, American consumers still had access to both. You can't really think that pushing this industry abroad is going to protect American consumers when it hasn't several times, in the past, on your watch.

You say the crypto market is rife with non-compliance. However, existing SEC rules make no sense for blockchain-based companies and following them would actually kill these businesses. Your regulatory style lacks flexibility and nuance and as a result, you've been an incompetent “cop on the beat,” doing nothing to protect everyday Americans and pushing American firms into the hands of the CCP.

Your intention to work against the SEC mission and put American investors in harm's way has been made very apparent, sir. It's been a year and a half since you've appeared before this committee, you need to answer to Congress about the issues that you've had with the SEC staff union, the work environment you've cultivated at the SEC that's led to hemorrhaging of senior staff, the intellectual inconsistency of your regulatory treatment towards bitcoin spot ETFs, and your politicization of capital formation opportunities through your treatment of certain SPACs, and that's just to name a few.

Thank you, I yield back.

###